English UK, the peak body for English-language teaching (ELT) in the UK, has released full-year data for 2024 that shows a 9% decline in student weeks relative to 2023.

The ELT trends are reported in the association’s QUIC Q4 2024 report, which includes full-year data for the year. The report is based on data from the 125 reporting members (out of the association's member base of 307 schools) that participated in English UK's Quarterly Intelligence Cohort (QUIC) programme in 2024.

UK may outperform other “Big Four” destinations

Despite the decrease, industry research firm BONARD predicts that UK ELT providers will end up “outperforming” counterparts in Australia, Canada, and the US in 2024. In 2023, the UK’s post-COVID recovery was slower than Australia’s, but it has since become more difficult for ELT students to get a visa for Australia.

Junior segment is taking longer to rebound

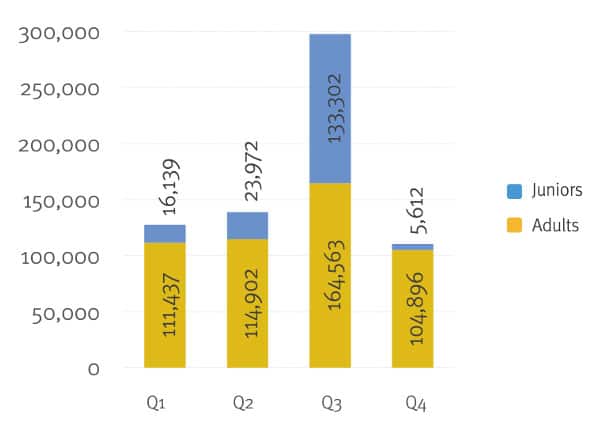

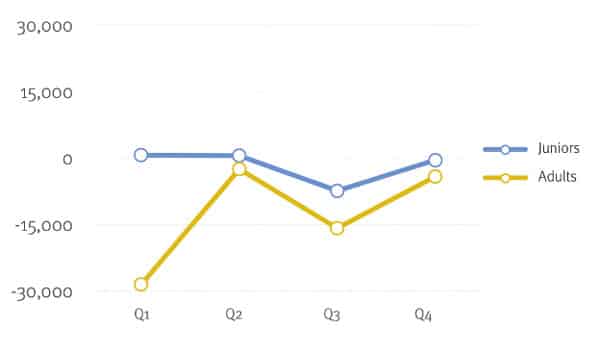

The 9% decrease in UK ELT student weeks was cumulative and based on business recovering to 87% of 2023 levels in Q1, 99% in Q2, 91%, in Q3, and 96% in Q4. However, when compared with 2019, Q4 2024 reached only 72% of student weeks – and 65% for the Junior segment.

The Adult segment represents the highest proportion of all weeks. In the summer – Q3 –Junior weeks always reach their peak given younger students’ greater ability to travel in their seasonal break (Figure 1). Across all of 2024, the Adult segment recovered more substantially than the Junior segment (Figure 2

Figure 1. Adult and Junior weeks across all four quarters of 2024. Source: English UK

Figure 1. Adult and Junior weeks across all four quarters of 2024. Source: English UK

Figure 2: Absolute year-over-year changes in student weeks by quarter, 2023 vs. 2024. Source: English UK

Figure 2: Absolute year-over-year changes in student weeks by quarter, 2023 vs. 2024. Source: English UK

Decline stems from several factors – only some of which are quantifiable

Ivana Bartosik of BONARD explained that from a tracking perspective, 2023 is likely to be the new benchmark year for performance going forward given the extent to which the pandemic disrupted student mobility (and data on it). For example, neither 2023 nor 2024 were characterised by pandemic effects, and so the decrease in business levels is caused by other factors.

Those factors include some combination of conditions in source markets, exchange rate fluctuations, degree of access to quality English-language teaching in students’ home countries, and the extent to which students are turning to digital alternatives to in-person instruction.

In addition, English UK says other reasons for the 9% year-over-year decrease registered in 2024 may be “the shift of student flows to newer, often more price-conscious ELT destinations such as Dubai, the Philippines, and Malaysia.” This is not quantifiable, however, given a lack of robust data in those countries.

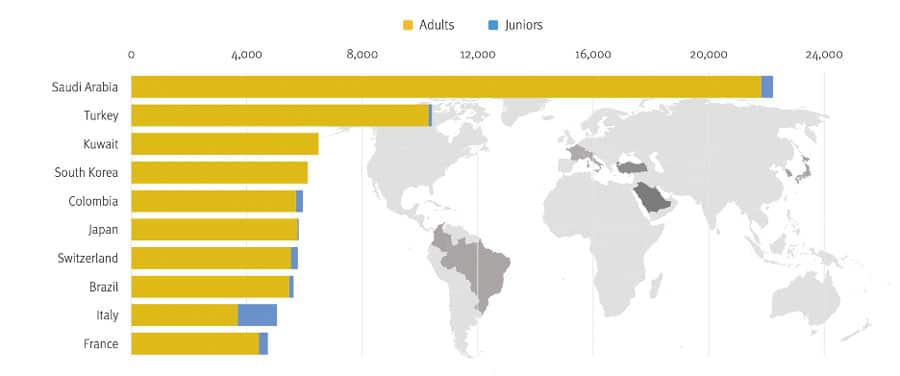

Top markets for UK ELT in Q4

Saudi Arabia remained by far the top sending market for UK ELT providers in the last quarter of 2024. Second-place Türkiye grew the fastest compared with 2023, while Switzerland and Brazil contributed fewer weeks. The full Top Ten list (also shown in Figure 3 below) is as follows, and these countries represent 71% of all student weeks:

Saudi Arabia

Türkiye

Kuwait

South Korea

Colombia

Japan

Switzerland

Brazil

Italy

France

Figure 3: Top Ten markets for English UK member centres, 2024. Source: English UK

Figure 3: Top Ten markets for English UK member centres, 2024. Source: English UK

CONTACT FORM

Find out how we can cater to your specific needs

We look forward to assisting you further and explaining how our services can benefit you.